A Joint Study Between Prevue Magazine and the Incentive Research Foundation

Talk to any planner or hotel sales person and they will tell you that the meetings industry is a relationship business. We teamed up with the Incentive Research Foundation to put that statement to the test with the first-ever survey asking both sides the same questions about how they work together. Conducted this past July, our meetings research is based on the responses of 160 meeting planners and 126 hotels, ensuring a 95 percent confidence rate in the results and a +/- 8 percent confidence interval. (More meetings research here.)

Introducing the Hotel-Planner Relationship

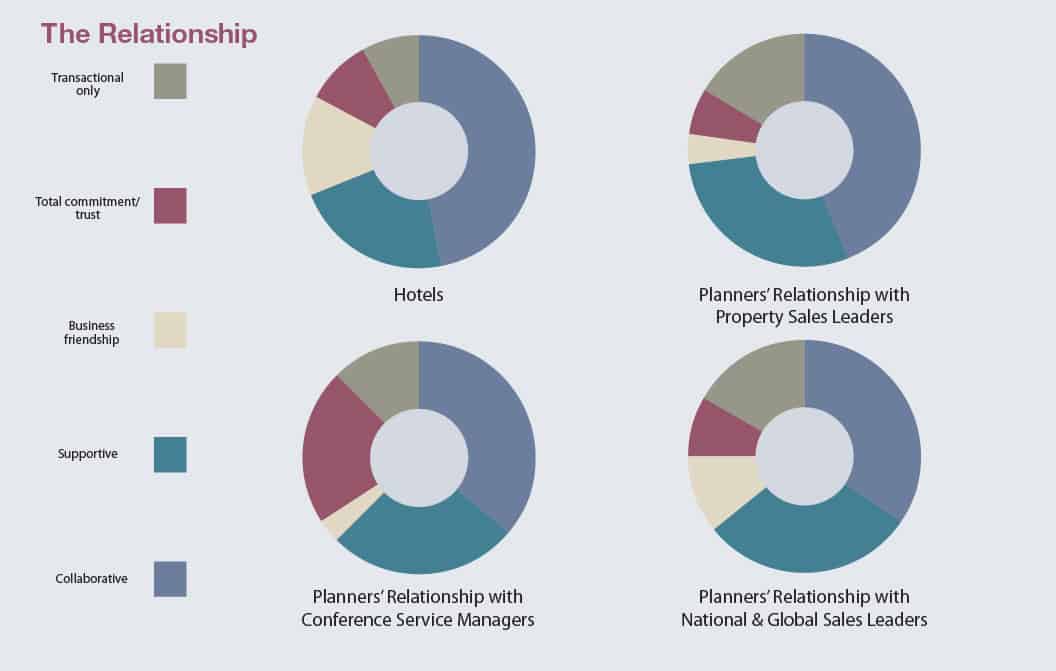

The good news is that overall, meeting planners and hoteliers feel a sense of commitment and collaboration when working together, slightly more so on the hotelier side. The level of teamwork and commitment meeting planners feel also varies according to role—e.g., national sales manager vs. property sales leader vs. conference services manager. When it comes to the relationships between planners and their CSMs and hotel sales person there is some work to be done. Only 19 percent of planners described their relationship with their CSM as one of “total commitment and trust,” and 6 percent described their relationship with their hotel salesperson in the same way.

Significant differences were also found in the perception of the planner-hotelier relationship itself—whether each viewed the other to be “business friends” or business as usual. As it turns out, hoteliers are more likely to view planner customers as business friends, while planners when referring to their property salesperson and CSMs used that description infrequently. In fact, 15 percent of planners described their relationship with their hotel sales people (and global/national sales reps) as “transactional only.”

Where Each Side Brings the Most Value

It’s clear from the survey results that hotels look to their meeting planner partners for strategic direction, while planners expect flawless execution from their hoteliers. Many planner respondents would like to see hotel counterparts expand their roles beyond logistics, educate themselves and their staffs on the program and become stronger partners.

She said: “They are putting so much pressure on sales people to book business. As a result, they are making too many mistakes, taking too long to get answers and not engaging in our goals. They’re not even asking about them.”

He said: “I need to be more cognizant of clients needs and vision for their event—to try to see it from their perspective.”

Challenges in the Planner-Hotel Relationship

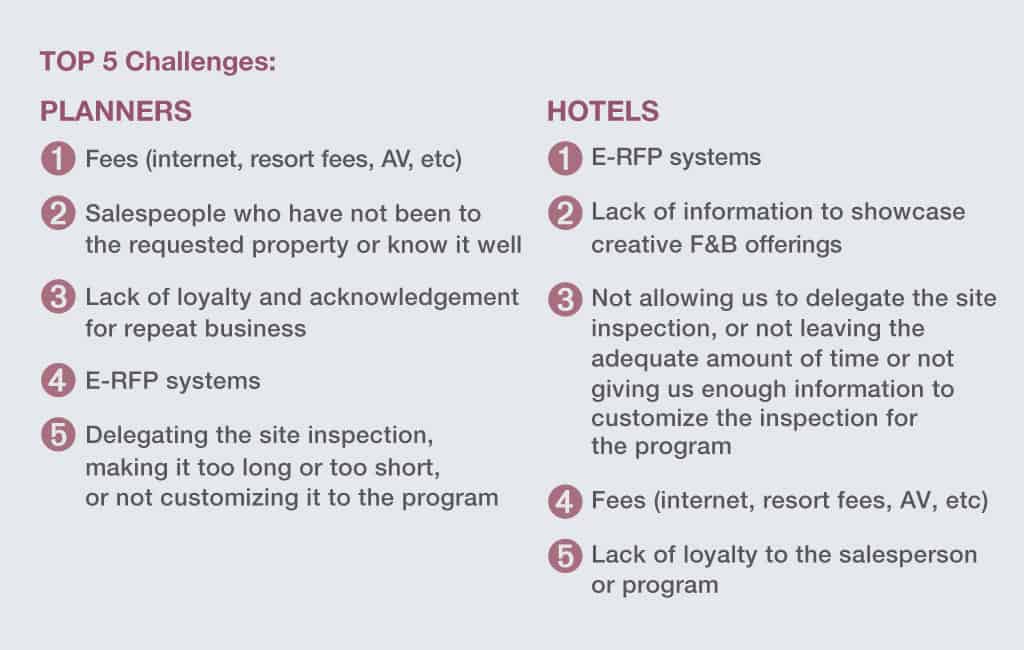

For planners, hotel fees were at the top of the list. Many referred to being “nickeled and dimed”; as one put it: “Hotels need to train their sales managers to fully understand hard and soft costs. It costs the hotel pennies on the dollar, compared to what it actually costs the client, for the same service.”

Those fees can be the tipping point for associations. Said one planner respondent. “When a hotel is able to negotiate things like parking fees, resort fees and internet fees that would normally add to the room cost, we are more able to work with them. We almost always end up spending the money we saved on F&B, AV or other amenities, but it helps to keep the room cost down, especially when guests are paying for their own rooms.”

E-RFPs have also de-personalized the site selection experience and rank high on the list of frustrations for both sides. Planners feel hotels often don’t review them thoroughly, take the time to understand their needs, or reach out personally to see if there is any flexibility on dates or other concessions that can be made before responding with a no.

“Call me ‘Old School’ and inefficient, but I prefer to send customized event details to an actual human rather than making my meeting details fit into a pre-determined set of boxes and sending it off into the abyss,” said Meghan Schilt, CMP, events manager, King & Spaulding. “Not to mention that in this current environment, meetings are being boiled down to numbers. In some cities, to give my meeting a fighting chance at getting preferred space, I need to rely on relationships.”

Response times are a complaint on both sides, but the biggest issue is the breakdown in communication. “The hotels I often give the business to are the ones who pick up the phone to discuss flexibility, priorities and key objectives—those elements aren’t always made clear in an RFP,” said John C. Touchette, CMP, vice president global meetings, events and trade shows, Raytheon.

Getting the Scoop on New & Potential Venues

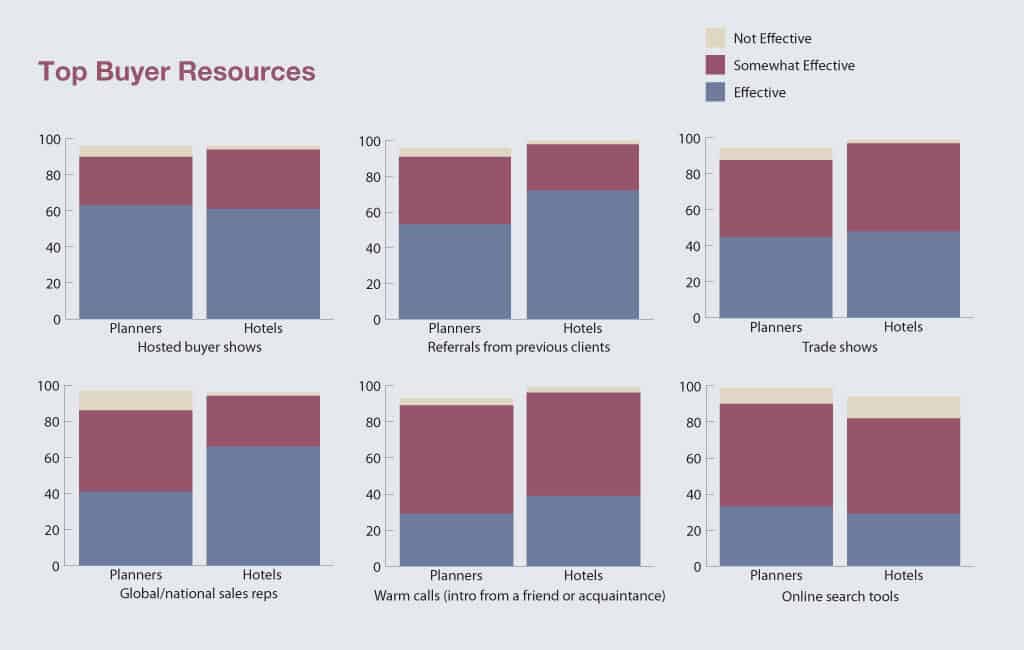

When planners are evaluating hotels, the human touch wins out over the web. For Maddy Caliri, director, global procurement at RELX (formerly Reed Elsevier), it’s also about efficiency: “My experience has been that the hosted buyer shows were much more targeted,” she says. “The suppliers had my information prior to our meeting, so I didn’t need to spend time educating them about my business.” Laura Yates, president, Dovetail Event Partners, refers to them as “the epitome of one-stop shopping.” But, that said, she has ended up frustrated by “being forced into making appointments with vendors or hotels that are an unlikely match for my needs. Not all hosted buyer programs are created equal.”

Issues in Execution

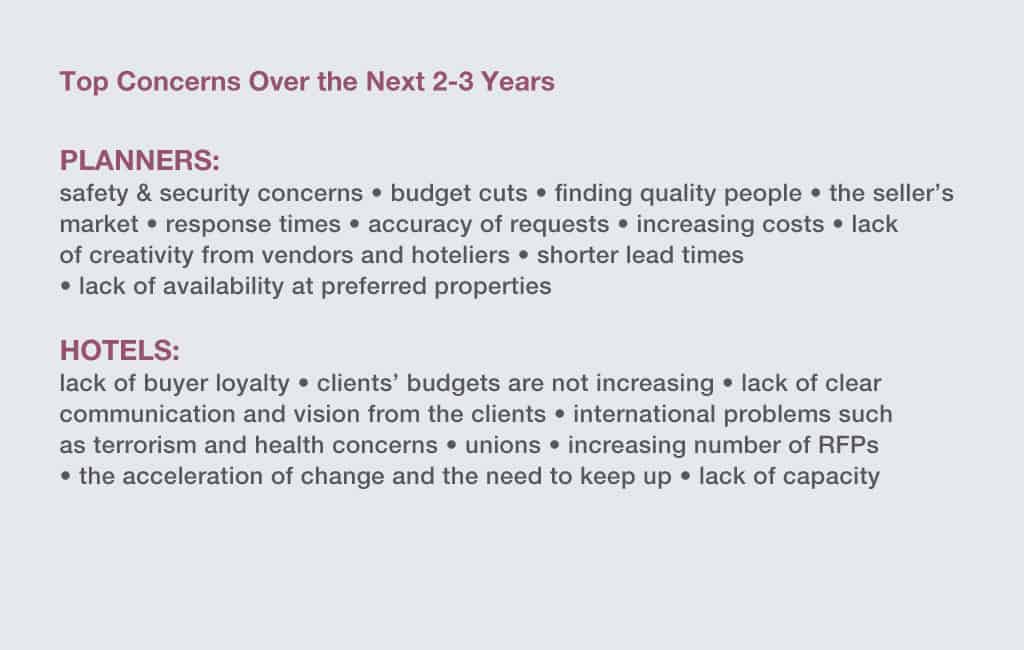

The pressures on both sides—planners and hoteliers—are enormous, as was revealed in the comments they shared when asked about the top issues affecting their ability to do their jobs.

Much of this has to do with the pace of change and with technology replacing relationships and roles. Overriding all concerns for planners is the seller’s market. Supply and demand has always influenced the buyer-hotelier relationship, but after having given hotels business through a lengthy recession, some planners feel they are being treated unfairly now.

“I need to see more flexibility and assistance in placing my meetings. It’s a seller’s market right now, but that will change and they will need the business. If a hotel partner is helpful right now, that planner will remember him or her when the economy changes,” said one planner.