RFPs and the hotel group room night index continued to show the industry is rebounding through the first half of 2023, according to the EIC Global Events Barometer. However, there may be headwinds coming.

RFPs and the hotel group room night index continued to show the industry is rebounding through the first half of 2023, according to the EIC Global Events Barometer. However, there may be headwinds coming.

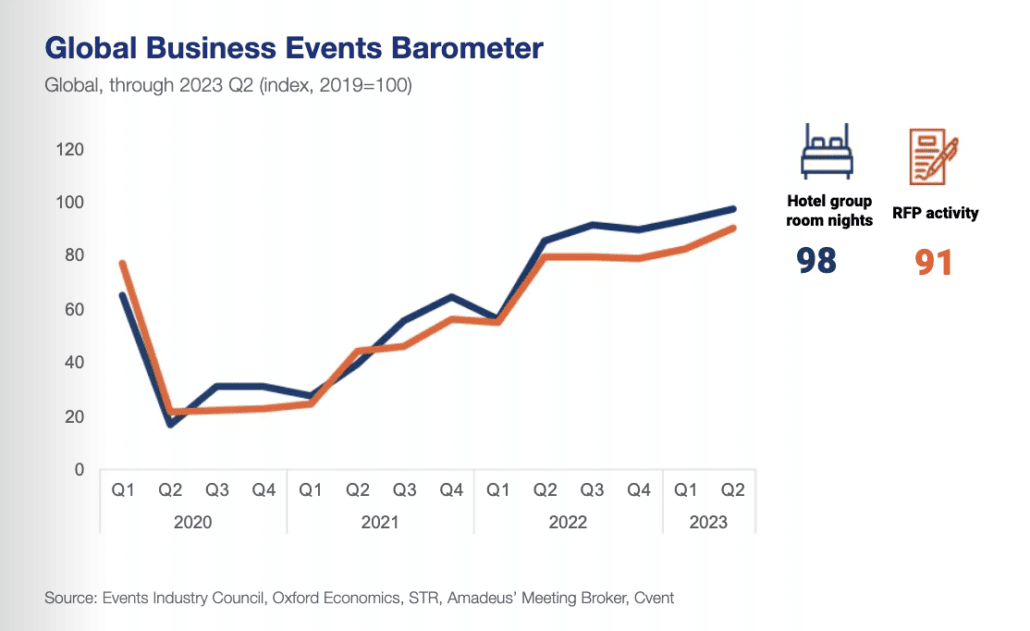

The meetings and events industry showed a second consecutive quarter of growth in both hotel room nights and in event requests for proposal (RFPs) through the first half of 2023, according to the Event Industry Council (EIC) Global Events Barometer for Q2 2023. The study, a follow up to the 2023 Global Economic Significance of Business Events Study released in May, was conducted by the EIC in partnership with Oxford Economics. The Global Events Barometer and the previous study are based on data from Amadeus Hospitality, Cvent, the Global Business Travel Association (GBTA), and STR Global to monitor the group meeting and event industry’s recovery post-pandemic.

RFPs are almost back to 2019 levels, meaning that the RFPs sent by event planners during the second quarter for future events increased to 91% the number sent during the same time period in 2019, according to the EIC Global Events Barometer. Leading the recovery charge in RFPs were large and medium-sized events, which actually bested 2019 levels, coming in at 103%. Smaller events still lag a bit, at 88% of 2019 levels. The RFP recovery did vary by geographic region, with some areas showing a faster rebound than others. Coming in at the top of the RFP rebound bounce were North America and the Middle East, which reached 116% and 128%, respectively. Specifically, Mexico’s RFP activity was up 157% over 2019 levels, the UK was up 139%, Turkey was up 123% and the U.S. was up 118%. At the bottom of the RFP recovery list were China and Austria, both at 60%, and Germany at 64%.

Group room nights booked at hotels fare even better, coming in at 98% of 2019 levels, according to the Global Events Barometer. The recovery in group hotel room nights was strongest in Western Europe, and weakest in Africa and the Middle East. India was the big winner in this area, at 140% recovery over 2019 levels. Thailand also was up 138%, while the U.S. was just below 2019 levels at 98%.

However, the report did anticipate some headwinds when it comes to growth in the latter half of this year, mainly due to cooling economic growth across various geographic areas. Of specific concern were geopolitical tensions in Taiwan, Korea and between Russia and NATO countries, cited by 36% as the top risk. A continued tightening in credit supply also caused concern among 23% of business leaders, who said this factor likely would continue to affect the global economy in general, and business events specifically. Inflation expectations also remained elevated, at 21%, though that is down slightly from the earlier report. While both climate change and a full-blown financial crisis clocked in as a top concern for only 7%, concerns about climate change had increased slightly, while worries about a global financial meltdown decreased considerably over Q2, according to the report.

“The total GDP impact of business events would rank as the 13th largest global economy. It is vitally important for our sector and stakeholders that we continue to measure and share the industry’s wide-ranging impact and leverage this forecast model to tell our best story,” said EIC CEO Amy Calvert. “Trade shows, association conferences, corporate events and incentive events also produce catalytic effects. Areas such as knowledge sharing, innovation and employee engagement go well beyond direct event spending.”

You May Also Be Interested In…

EIC: Global Events is a $1.6 Trillion Industry

Global Business Travel Forecast: High Demand, Rising Costs

Today’s Seller’s Market: Hotelier, Planners Weigh In